Agency Debt: Key Insights and Investment Opportunities

Are you familiar with the invisible backbone of the municipal landscape, silently fueling America’s infrastructure projects? Often overlooked by mainstream investors, agency debt plays a crucial role in our cityscapes’ expansion. Investing in this sector requires a nuanced understanding beyond glossy prospectuses and headline figures – knowledge that can unlock the potential of a staple in public finance.

Defining Agency Debt

Agency debt signifies bonds or securities issued by government-affiliated entities, such as a government agency, separate from direct obligations of the U.S. Treasury. These entities, while enjoying government sponsorship, do not typically carry the full faith and credit of the federal government.

Examples include Federal agencies or Government-Sponsored Enterprises (GSEs) such as Fannie Mae and Freddie Mac. Such debt is issued to finance activities related to the public good—ranging from home mortgages to rural development.

The terms “agency bonds” and “agency securities” are often synonymous, reflecting the diverse instruments available within this specialized investment niche.

Origins and Issuers

Agency debt emerges from a variety of government-affiliated entities established to fulfill public policy goals through the financing of specific sectors. Government-sponsored entities bolster sectors crucial to the national economy, providing liquidity and stability in critical markets. Entities like Fannie Mae and Freddie Mac, alongside Federal agencies, issue these securities to support housing finance, agricultural endeavors, education funding, and infrastructure initiatives. Instrumental in promoting economic growth and development, the issuers of agency debt are pivotal in channeling funds into essential segments of the economy.

Compared to Treasury Securities

Agency debt often carries a slightly higher yield compared to U.S. Treasury securities due to perceived additional risk. This risk differential stems from an implicit, rather than explicit, guarantee of repayment by the U.S. government, distinguishing Treasuries from agency securities. Moreover, market liquidity for Treasuries typically surpasses that of agency debt, reflecting their status as risk-free benchmarks for global investors. However, this difference in liquidity premium does not significantly detract from the agency debt’s appeal, considering its credit rating is commonly just one notch below Treasuries. Investors weigh these factors judiciously, balancing yield considerations with the fundamental safety of their principal.

Investment Considerations

Credit Risk Analysis is critical when evaluating agency debt instruments, as their backing varies by issuing entity and purpose.

Understanding the Tax Implications of agency debt investment is essential, as it may differ from other fixed-income securities and impact overall returns. State and local taxes, as well as federal considerations, can influence net income.

Interest Rate Fluctuations pose a significant risk to agency debt, influencing market value and yield, just as with any other fixed-income security.

Risk and Safety

Agency debt carries a lower risk compared to corporate bonds but isn’t as secure as Treasury securities.

- Credit Quality: Agency debt typically holds high credit ratings, although usually one notch below U.S. Treasuries, suggesting a low default risk.

- Implicit Guarantee: While not explicitly guaranteed by the U.S. government, there’s often an implicit expectation of support, reducing perceived risk.

- Interest Rate Risk: As with all fixed-income assets, rising interest rates can negatively impact agency debt prices, creating potential capital loss.

- Market Liquidity: Agency debt often has less liquidity than Treasuries, which may affect pricing and the ease of entering or exiting positions.

- Prepayment Risk: Some agency debt is subject to prepayment, as borrowers may pay off their loans early, potentially leading to reinvestment risk at lower yields.

Evaluate the specific issuing agency and its financial stability to assess the safety of an agency debt investment. Risk profiles may subtly shift with macroeconomic changes, making ongoing due diligence imperative for agency debt investors.

Interest Rates and Returns

The relationship between interest rates and agency debt yields is fundamental to understanding return potential. Most agency debt is sensitive to changes in the broader interest rate environment, which significantly affects yields. When the Federal Reserve adjusts rates, agency debt investments tend to react accordingly, often echoing the rise or fall of benchmark rates.

Traditionally, agency debt offers a spread over Treasuries, which reflects compensation for slightly increased risk. However, this spread can fluctuate based on market conditions and sentiment toward government-sponsored entities. Investors must gauge whether the risk premium on agency debt justifies its position within their portfolio, especially during periods of volatile interest rates.

In evaluating returns, investors should consider the yield curve’s shape and trajectory, which provides insight into market expectations for interest rates. A flattening or inverting yield curve suggests diminishing returns for longer-term agency debt relative to short-term securities, which could influence investment strategy decisions.

Agency debt instruments may offer fixed or variable interest rates, impacting the returns under different economic scenarios. Fixed-rate agency debt provides consistent income but may lose market value if interest rates climb. Conversely, variable-rate agency debt income may increase with rising rates, offering a measure of protection against interest rate risk.

Yield-seeking investors should scrutinize the tax implications of agency debt returns. Some may offer federal tax advantages, which can enhance after-tax returns and make them an attractive option for tax-sensitive portfolios. Always consider your individual tax situation and consult with a tax advisor when assessing the potential benefits.

Agency Debt Markets

The agency debt market is a robust segment of the fixed-income landscape, comprising securities issued by government-sponsored enterprises and federal agencies. These entities, such as Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, issue debt to fund their operations and to support their mandates in sectors like housing and agriculture. The distinct credit profiles, backed by implicit or explicit government guarantees, make agency debt a staple for investors seeking a balance of safety and yield.

Strict regulatory oversight and the unique role of issuers in public policy contribute to the stability and attractiveness. Beyond the default risk mitigation through implicit government support, agency debt offers liquidity second to the U.S. Treasury market, providing a compelling option for fixed-income investors who desire ready access to their capital.

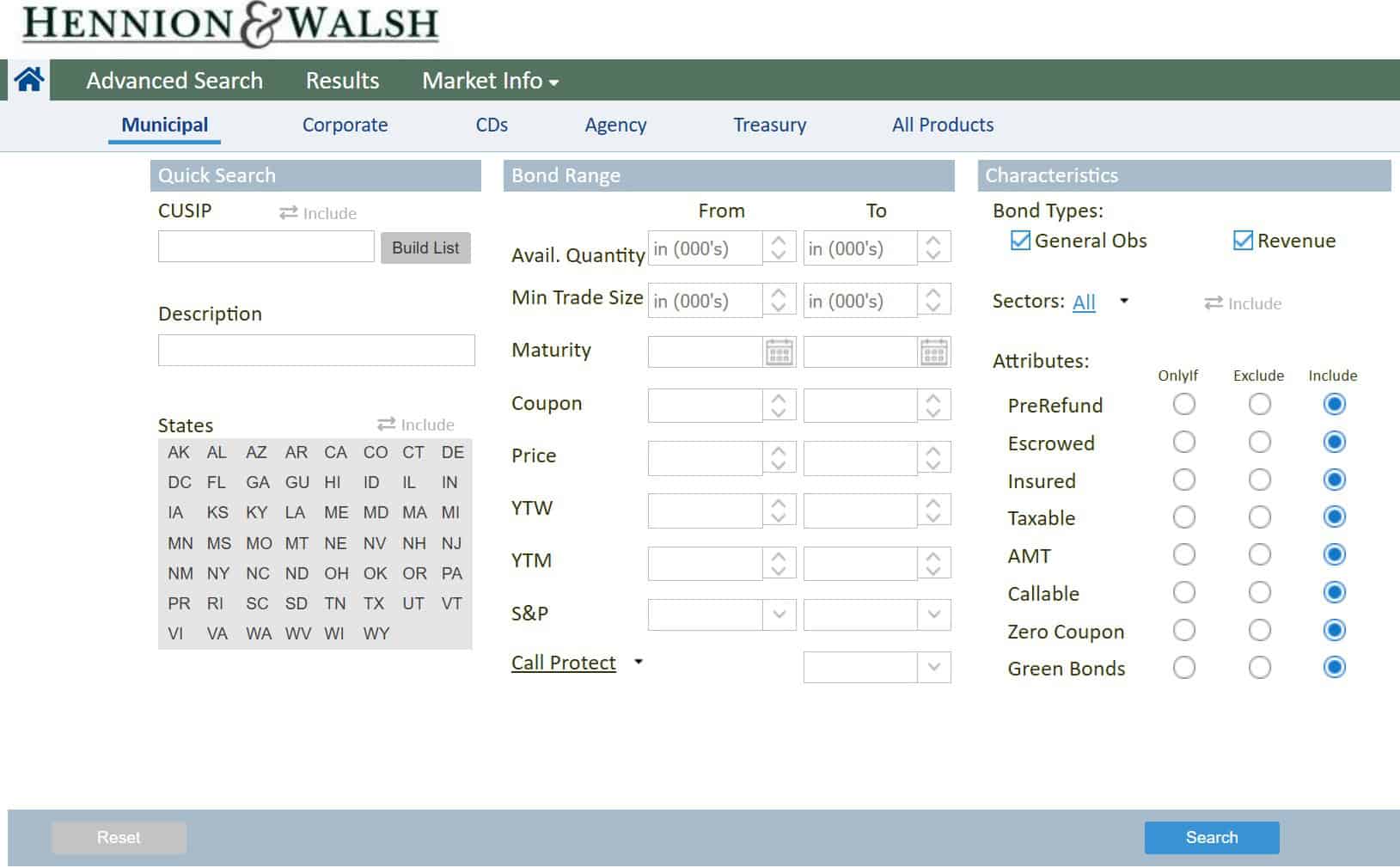

How to Buy and Sell

Agency debt is primarily traded in the over-the-counter (OTC) market, facilitated by a network of dealers. For individual investors, agency bonds can be purchased through brokerage firms that access this dealer network. Minimum investment levels may vary depending on the specific bond and the policies of the brokerage. Transactions are often settled through a process known as delivery versus payment (DVP), ensuring the security transfer only occurs once payment is received.

Broker-dealers act as critical intermediaries, providing price transparency and execution services, but they may charge a markup that affects the purchase or sale price of the bond. When selling before maturity, market conditions will determine the prevailing price, impacting the potential return on the investment.

Market Liquidity and Size

The agency debt market is distinguished by its substantial liquidity, overshadowed only by U.S. Treasuries, making it a dominant player amongst fixed-income assets. Its depth provides resilience during economic fluctuations, maintaining more stable pricing than less liquid markets.

Agency securities offer a diverse pool of investment opportunities, contributing to the robustness of this market segment. This market’s vast size supports its high liquidity, ensuring that significant transactions can be executed with minimal impact on price.

Investors considering agency debt should be heartened by the market’s sizable trade volume, which enables a level of flexibility and ease in entering or exiting positions. Nevertheless, the liquidity can vary between different agency issues, with some offering narrower spreads and greater ease of trade than others.

Regulatory Landscape

Agency debt is subject to intricate regulatory oversight aligning with securities law and stringent market standards, safeguarding investors through rigorous disclosure requirements and strict compliance protocols. These oversight mechanisms serve to ensure the integrity of the market and uphold investor confidence, particularly through periods of economic volatility and fiscal uncertainty.

Recent amendments to regulations have emphasized greater transparency and enhanced due diligence, compelling issuers to provide investors with extensive documentation detailing the financial health and projected performance of the issuing entity. These regulatory refinements fortify investor safeguards, fostering a more scrupulous and informed investment environment.

Government Oversight

Municipal bonds play a crucial role in government oversight, ensuring issuers adhere to sound fiscal practices and maintain transparency. This oversight is a critical component of preserving the integrity of the municipal bond market and protecting investors’ interests.

The labyrinth of regulatory compliance in which agency debt operates is upheld by entities at various levels of government, from municipal securities rules promulgated by the SEC to local mandates ensuring fiscal responsibility. Oversight agencies monitor the ongoing financial performance of issuers, enforcing standards that protect investors from undue risk and additional compliance burdens. These measures are designed to bolster the trust and efficiency crucial to sustaining investor engagement and market stability.

Moreover, oversight entities may also act as arbiters in the event of disputes, providing an essential layer of investor protection. This regulatory framework, while complex, serves a pivotal role in maintaining the delicate balance between issuer autonomy and the need for a well-regulated marketplace that fosters transparency and investor confidence.

In conjunction, credit rating agencies play an instrumental role in offering an informed perspective about the creditworthiness of issuers. While independent from direct government control, these credit rating agencies assess various factors that may impact an issuer’s ability to meet obligations, providing an invaluable resource for investors navigating the market’s complexities. Their evaluations, though not infallible, are fundamental components of the investment decision-making process, converging market dynamics with the regulatory landscape to form a cohesive picture for investors.

Impact of Changing Laws

Legislative amendments can significantly influence agency debt, altering risks and rewards for bondholders.

- Revised Tax Codes: Changes to tax laws may affect the tax-exempt status of municipal bonds, directly impacting their appeal to investors.

- Regulatory Adjustments: Shifts in regulations can redefine the accountability and transparency standards for issuers, affecting bond valuations.

- Environmental Legislation: New environmental laws can necessitate additional investments from issuers, potentially impacting their financial stability and bond ratings.

- Bankruptcy Code Revisions: Alterations to bankruptcy proceedings can transform recovery prospects for bondholders in the event of an issuer default.

- Interest Rate Caps: Legislative imposition of interest rate caps can limit the earnings potential on municipal bonds.

Such statutory transformations could necessitate a portfolio reassessment to mitigate newly introduced risks. Anticipation of law changes is paramount; proactive portfolio adjustment can protect against adverse impacts.