How Tax-Free Municipal Bonds Work: A Comprehensive Overview

How can investors simultaneously seek financial growth and minimize their tax-related burdens? That’s where tax-free municipal bonds come into the picture. These remarkable securities offer a dual advantage: They generate income that is often exempt from federal income taxes and sometimes even state and local taxes, depending on where you reside. By investing in these bonds, you’re not only fortifying your financial portfolio but also supporting essential public projects, such as schools and infrastructure, fostering broader economic development with the promise of stable returns.

What Are Tax-Free Municipal Bonds?

Tax-free municipal bonds, often called munis, are financial instruments issued by local governments and other governmental entities like states and school districts.

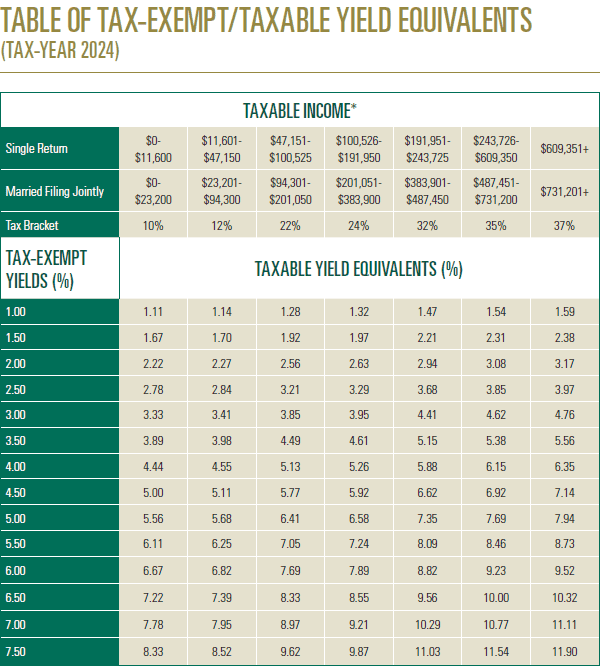

These bonds, primarily designed to fund public projects, offer investors an attractive opportunity to generate income with a fixed coupon rate while leveraging the advantage that their interest payments are typically exempt from federal income tax. This tax exemption can significantly boost their appeal, particularly for investors in higher tax brackets seeking a way to maximize after-tax returns.

Moreover, these bonds may be exempt from state and local taxes if purchased by residents of the issuing state. However, tax benefits vary based on specific state and local laws. For this reason, tax-free municipal bonds are especially effective for local residents, allowing them to support community projects while enjoying enhanced tax efficiency in their investment portfolios.

Curiously, the demand for tax-free municipal bonds tends to rise during periods of economic uncertainty and fluctuating interest rates. This is due to their propensity to offer stability and predictable income flow, making them a robust choice for conservative investors desiring a steady hand in their financial journey. Investing in these bonds often aligns with both individual financial goals and broader societal contributions, encapsulating the essence of progressive financial planning.

Benefits of Tax-Free Municipal Bonds

Investors cherish the numerous benefits these bonds offer.

Primary among these is the advantage of tax-exempt interest. This perk enables investors to retain more of their earnings, essentially enhancing the net income received from their investment in tax-free municipal bonds. Intriguingly, the allure of these bonds extends beyond the federal tax exemption; local and state tax exclusions further intensify their profitability.

Returns, while influenced by interest rates, can be particularly valuable to high-income individuals.

Investors can rest assured knowing that their capital contributes not only to personal financial growth but also to essential community projects. The double benefit of financial gain and civic contribution provides a unique investment opportunity.

With all these factors at play, tax-free municipal bonds promise an unrivaled aura of fiscal responsibility and personal gain. The enduring nature of these bonds assures a stable income and secures participation in fostering community development.

Types of Tax-Free Municipal Bonds

Each is tailored to a diverse range of public demand and fiscal ambitions, enveloping a multifaceted investment landscape with promising prospects.

General obligation bonds are backed by the issuer’s full faith and credit, relying on taxing authority to meet obligations. Revenue bonds, however, depend on income generated from specific projects, such as toll roads or utilities, which may introduce additional project-specific risks.

Conversely, revenue bonds shift the repayment focus to specific revenue sources such as tolls or lease fees. Each bond type serves a distinctive purpose, channeling investments into vital infrastructure projects, while rewarding investors with beneficial returns. Various issuances may include additional protective covenants, assuring investors of the issuer’s commitment to prompt interest payments and ultimate principal repayment.

Altogether, the world of tax-free municipal bonds is robust with opportunity. Engage with these securities to align personal financial goals with purposeful community initiatives, driving progress and prosperity simultaneously.

How to Invest

Investing is a strategic avenue to pursue consistent income while promoting essential public projects. How does one embark on this rewarding investment journey?

First, establish your investment goals, assessing your risk tolerance and desired income. Are you seeking long-term growth, or is immediate income more aligned with your financial ambitions? Once defined, you can explore municipal bond offerings through brokerage platforms or investment advisors who specialize in fixed-income securities. They can provide access to primary and secondary bond markets.

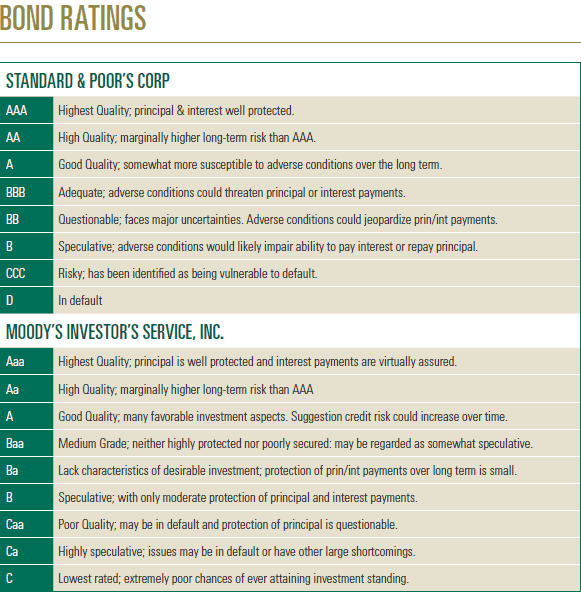

As you evaluate potential bonds, consider the bond’s credit rating, interest rates, coupon rate, and maturity. Go beyond the yield, assessing the broader fiscal health of the issuing municipality and the project’s social impact. With informed decisions, investing in tax-free municipal bonds becomes a powerful tool to balance personal wealth growth and community advancement.

Risks of Tax-Free Municipal Bonds

Interest rate risk is significant, particularly for bonds with longer maturities. Rising interest rates typically reduce bond values, impacting their resale potential before maturity. Consequently, investors must be mindful of the market dynamics, which may impact the bond’s resale price before maturity. However, maintaining a focus on the bond’s underlying fundamentals can mitigate the potential impacts of market volatility.

Credit risk also deserves consideration. The financial stability of municipalities can affect their ability to satisfy bond obligations.

Additionally, liquidity risks may arise – as these bonds might not attract as many buyers or sellers in the market – leading to potentially limited opportunities for offloading investments when necessary.

Tax policy changes can also alter the attractiveness of tax-free municipal bonds, particularly if new legislation in the future impacts their tax-exempt status. While these risks present challenges, the rewarding potential of municipal bonds underpins their value in an investment portfolio committed to sustainable and community-focused growth.

How to Find the Best Tax-Free Bond Yields

Maximizing tax-free income starts with knowing where to look. At Hennion & Walsh, our investment professionals provide current market insights and tailored recommendations to help you compare yields across a broad range of municipal bonds. We focus on opportunities that deliver reliable, tax-exempt income while maintaining high credit quality so you can make the most of your investment.

Choosing the Right Investment

Aligning choices with investment goals is crucial, and understanding the bond’s coupon rate can help determine the income potential relative to current market conditions.

When selecting tax-free municipal bonds, consider the issuer’s credit quality. The importance of this cannot be overstated, as higher credit ratings can indicate a higher likelihood of consistent interest payments, even in varying interest rates environments, and return of principal. Furthermore, focus on the bond ratings from agencies like Moody’s or Standard & Poor’s for an accurate assessment of potential risks and rewards.

Consider the geographic area of issuance, especially if you aim to benefit from state and local tax exemptions. However, diversification across projects and issuers is key to mitigating geographic concentration risks.

The tax advantage of tax-free municipal bonds is enticing—this can significantly benefit investors residing in the same state. Thus it’s paramount to examine the state and local tax regulations and rates to maximize after-tax returns.

In sum, crafting a strategy for tax-free municipal bonds involves analyzing credit strength, geographic distribution, and market interest rates. With proper research and thoughtful selection, you can amplify returns, strengthen your investment portfolio, and support societal progress through strategic allocation in municipal growth.

Disclosure: All investments involve risk, including loss of principal. Past performance does not guarantee future returns. The interest on municipal bonds, unless identified as “taxable” or “AMT” (alternative minimum tax), is exempt from federal income tax, but may be subject to state income tax for residents of certain states. For bonds identified as “taxable,” the income may be subject to federal and state income tax. For bonds designated “AMT”, taxes may exist for certain investors. For bonds purchased at a market discount or bonds identified as “OID” (original issue discount) the difference between the purchase price and par value may be treated as taxable interest rather than capital gain.