Maximizing Wealth with Roth Conversions: A Strategy for High-Income Earners

Recent tax reforms have made Roth conversions increasingly appealing. Take, for instance, Jane, a successful entrepreneur who deftly navigated her financial landscape to maximize tax efficiency through a Roth conversion.

Utilizing Roth conversions for high-income earners can significantly enhance long-term financial planning. This strategic move allows individuals to transform their tax-deferred accounts into a tax-free growth powerhouse.

Understanding Roth Conversions

Roth conversions are a pivotal component in advanced tax planning strategies. But what exactly are they, and why should high-income earners consider them?

In essence, a Roth conversion allows the transfer of funds from a traditional IRA or 401(k) into a Roth IRA. This maneuver involves paying taxes on the converted amount at the time of the conversion but offers significant tax-free growth potential thereafter.

For high-income earners, this strategy can provide substantial benefits. By converting during lower income years or leveraging available tax deductions, they can minimize conversion costs and maximize the tax-free growth of their assets.

Moreover, unlike traditional IRAs, Roth IRAs do not have required minimum distributions. This provides high-income individuals with greater flexibility and control over their retirement funds, allowing the investments to grow undisturbed for potentially decades longer.

In summary, Roth conversions can transform a taxable situation into a vehicle for long-term, tax-free growth, an enticing prospect for high-income earners aiming to optimize their financial future.

Benefits of Roth Conversions for High-Income Earners

One significant advantage lies in the realm of tax-free growth potential within Roth IRAs.

For high-income earners, who often face steep tax brackets, a Roth conversion can be revolutionary. By strategically converting during low-income years, they may pay less in taxes.

Additionally, Roth IRAs do not mandate required minimum distributions (RMDs), providing greater autonomous control over one’s retirement funds. The absence of RMDs allows assets to compound over a longer period.

Furthermore, a Roth IRA can act as a superb estate planning tool. High-income earners can leave a tax-free inheritance to their heirs, potentially covering generations. Unquestionably, the benefits highlight the importance of tactical financial planning for maximizing long-term wealth.

Tax Implications of Roth Conversions

Understanding the tax implications of Roth conversions is crucial, especially for high-income earners who navigate intricate financial landscapes.

Roth conversions involve paying taxes on converted amounts. Thus, strategically timing conversions can optimize your tax liability and future tax-free growth within the Roth IRA.

However, it is essential to assess the impact of a Roth conversion on your current and future tax situation. For high-income earners, converting a significant amount in one tax year can push you into a higher tax bracket. This requires careful planning to minimize adverse effects.

Ultimately, with an astute approach, the benefits of Roth conversions can far outweigh the costs, setting the stage for a robust, tax-efficient retirement strategy.

Timing Your Roth Conversion

Timing your Roth conversion is paramount to optimizing financial advantage and minimizing tax impacts. Ideally, choose low-income years, market downturns, or pre-retirement periods to make conversions more beneficial.

Effective timing leverages tax brackets and avoids unnecessary high costs, maximizing long-term growth.

Best Times of the Year

Certain times of the year offer strategic advantages, making Roth conversions for high-income earners especially beneficial. Careful planning can significantly enhance the overall financial outcome.

Consider late in the year after assessing annual income, or during a “lower income” year. Early in the year is also an option, enabling recharacterization if market conditions change. Market downturns present an optimal opportunity for Roth conversions by reducing the amount taxed.

Additionally, high-income earners should leverage periods of income reduction, such as sabbaticals or job transitions. These times can effectively lower tax brackets, making Roth conversions less costly and more advantageous. Strategic conversions during these periods can lead to substantial tax savings and heightened future returns.

Market Conditions to Consider

Market conditions play a pivotal role in optimizing Roth conversions.

Understanding market cycles can help gauge the best times to convert assets. A downturn in the market, for instance, presents an excellent opportunity to shift investments into a Roth account, as the value will likely appreciate over time. Consequently, conversions at lower asset values can reduce the taxable amount, making the overall process more advantageous.

Market rebounds can enhance future growth. Continuously monitoring market trends is essential – not only to capitalize on favorable conditions but also to prevent conversions during peak market periods. Such vigilance ensures conversions are made strategically and yield long-term benefits.

Considering economic indicators like inflation rates, interest rates, and market volatility is vital to make well-informed decisions. By carefully analyzing these factors, high-income earners can craft a resilient conversion strategy that aligns with their financial goals, ensuring a prosperous and secure future.

Backdoor Roth IRA Strategy

For high-income earners, a backdoor Roth IRA strategy can be a game changer. This approach allows those who exceed income limits for direct Roth IRA contributions to still benefit from tax-free growth.

By contributing to a traditional IRA first—a strategy known as a ‘backdoor route’—high-income earners who exceed the Roth IRA income limits can then convert those contributions to a Roth IRA, effectively sidestepping the restrictions. This approach enables them to leverage the Roth IRA’s growth potential, allowing their wealth to compound tax-free for retirement.

Steps to Implement a Backdoor Roth IRA

Firstly, open a traditional IRA account if you don’t already have one.

Second, fund the traditional IRA with your maximum allowable contribution.

Next, wait for the funds to clear, then convert the traditional IRA to a Roth IRA. This conversion will be taxable, but the amount will have a significant growth potential in a Roth.

Finally, ensure you fill out IRS Form 8606 to report your non-deductible contributions, keeping you compliant with tax regulations. By meticulously following these steps, high-income earners can unlock the transformative advantages of a Roth IRA, securing a bright financial future.

Legal Considerations for Backdoor Roths

Navigating the legal intricacies of a Backdoor Roth IRA requires meticulous compliance with IRS regulations to avoid unintended tax penalties.

- Pro Rata Rule: Ensure understanding of this rule’s impact, which requires you to include all traditional, SEP, and SIMPLE IRAs in the conversion calculation.

- Step Transaction Doctrine: Be mindful of this doctrine, as the IRS might scrutinize rapid traditional-to-Roth conversions if viewed as a single transaction to sidestep income limits.

- Form 8606: Essential for reporting non-deductible contributions; failure to file could result in penalties.

- Recharacterization Restrictions: Once a conversion is completed, reversing (or recharacterizing) it is no longer an option as of the Tax Cuts and Jobs Act of 2017.

High-income earners should not underestimate the implications of Roth IRA income limits. Consulting with a tax advisor can ensure that your strategy aligns with current tax laws and maximizes potential benefits.

Estate Planning Advantages

Roth conversions for high-income earners present substantial estate planning advantages by allowing tax-free growth on retirement savings. This can lead to significant wealth accumulation, benefit distributions, and long-term legacy planning.

In addition, Roth IRAs are not subject to required minimum distributions, augmenting the ability to transfer wealth to heirs.

Minimizing Future Tax Burden

Minimizing future tax burden through Roth conversions for high-income earners necessitates thoughtful planning, precise execution, and a keen understanding of tax dynamics.

Strategic Roth conversions reduce taxable income. Consequently, managing taxable income levels optimally can mitigate future tax liabilities. By converting traditional IRAs incrementally, high-income earners can strategically manage tax brackets.

Thus, thoughtful implementation of Roth conversions provides long-term tax efficiency benefits. High earners can protect their wealth from escalating future tax rates, which promotes long-term financial peace of mind.

Ultimately, proactive tax planning empowers high-income earners, fostering financial resilience and security.

Simplifying Estate Distribution

Roth conversions for high-income earners can simplify the distribution of estates to beneficiaries. Through strategic Roth conversions, you can prepay taxes, reducing tax burdens on your heirs significantly. This foresight enables a more streamlined estate distribution process as the need for beneficiaries to pay income taxes is minimized.

Additionally, Roth IRAs are exempt from required minimum distributions, allowing the account to grow undisturbed, potentially increasing the estate’s value. Overall, effective use of Roth conversions ensures a smooth, tax-efficient transfer of wealth.

Avoiding Common Pitfalls

When considering Roth conversions for high-income earners, it is essential to be aware of common pitfalls that can undermine the benefits of these strategic financial decisions.

Neglecting tax bracket management can result in substantial tax liabilities. Therefore, it is imperative to carefully calculate the amount to convert within your current tax bracket and strategic thresholds.

Overlooking the impact on Medicare premiums can also be costly, as conversions can increase your modified adjusted gross income (MAGI). Consequently, planning the timing and amount of conversions to minimize potential increases in Medicare costs is a wise approach.

Additionally, failing to understand state tax implications may lead to unexpected tax burdens, necessitating a thorough analysis of both federal and state taxes before proceeding. Finally, being unaware of partial conversions’ benefits can lead to lost optimization opportunities. Thoughtfully spreading conversions over several years can yield significant tax savings.

Calculating the Cost of Conversion

The cost of executing a Roth conversion is defined primarily by the taxes incurred, and considering the specifics, such as the current tax bracket, is of paramount importance. High-income earners must be cognizant of proportional tax nuances.

Essentially, converting traditional retirement funds to a Roth account will represent taxable income for that year. Therefore, precise calculations are necessary to understand potential tax obligations.

Exceeding a particular income bracket due to conversion may lead to an unexpected tax escalation, emphasizing the necessity of adept planning. Professional advisors can perform sophisticated calculations to ensure conversion strategies minimize tax burdens efficiently and effectively.

Alternatives to Roth Conversions

While Roth conversions offer substantial benefits, they are not the sole option.

High-income earners have various efficient tax strategies at their disposal. One such alternative is the strategic use of tax-advantaged accounts like Health Savings Accounts (HSAs) or maximizing contributions to traditional retirement accounts, which provide immediate tax deferrals. Additionally, considering the use of Tax-Loss Harvesting can optimize investment portfolios by offsetting gains with losses.

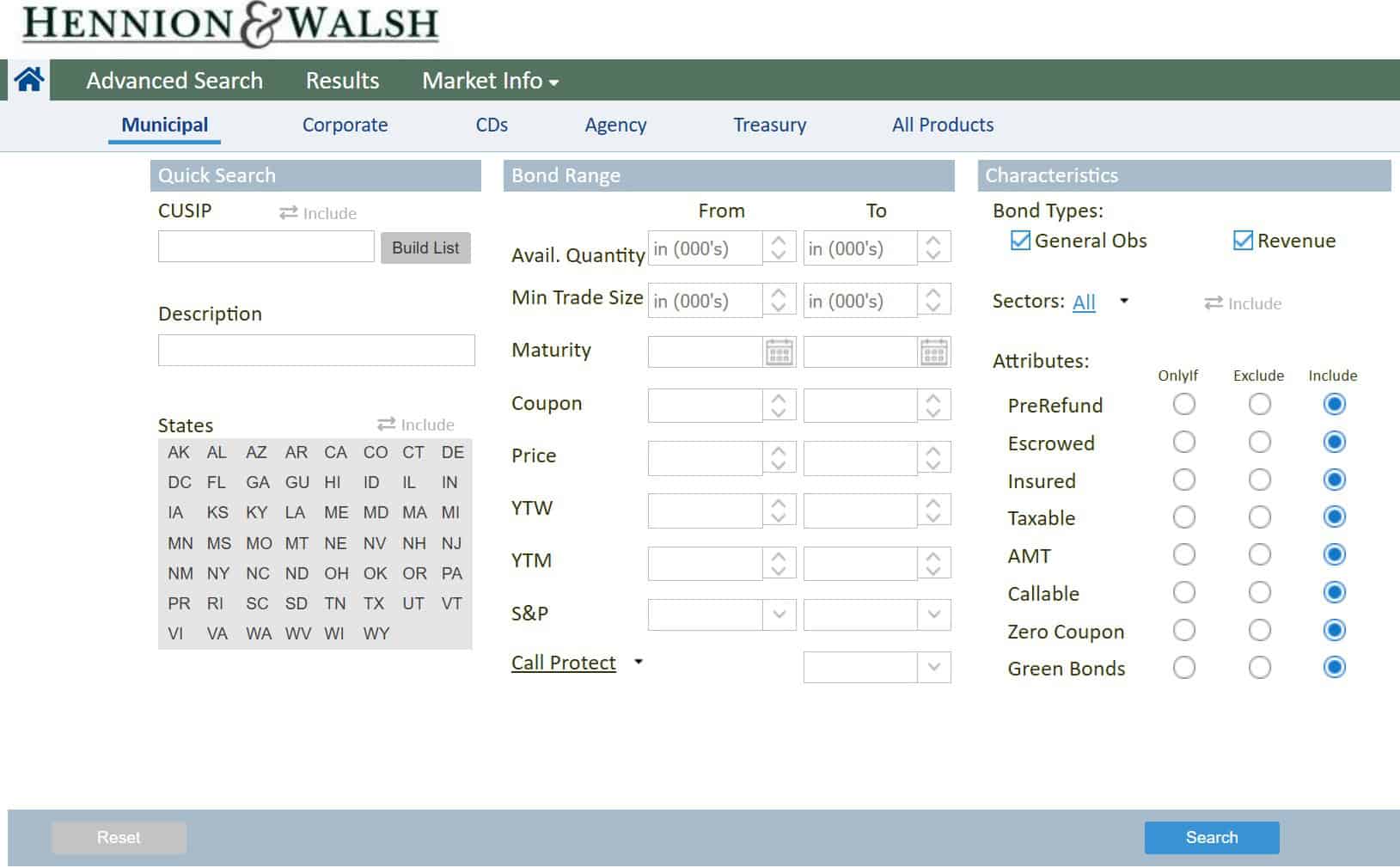

Other tried-and-true methods include municipal bonds. These bonds generate tax-free income and can be an integral component of a high-income earner’s portfolio. Further, contributing to a Donor-Advised Fund (DAF) can leverage charitable donations.

This philanthropic strategy not only provides significant tax deductions but also facilitates a structured approach to charitable giving. For high-income earners with substantial appreciated assets, a charitable remainder trust (CRT) presents another tax-efficient tool by converting appreciated assets into an income stream, accompanied by charitable tax deductions.

Long-Term Growth Potential

Unlocking the true potential of Roth conversions for high-income earners requires a forward-thinking perspective focused on long-term growth.

Taxes might seem daunting today. However, current tax rates may be favorably compared to rates in retirement, making prepaying taxes today a smart move. Paying taxes on conversions now can lead to significant future gains.

High-income earners, by opting for Roth conversions, can take advantage of the tax-free growth and withdrawals provided by Roth accounts. This long-term incentive fosters financial independence, security, and the opportunity to maximize estate planning benefits, ensuring financial assets can burgeon uninhibited by future tax liabilities.

Disclosures:

This commentary is not a recommendation to buy or sell a specific security. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation. Investing involves risk including possible loss of principal. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss.