Wealth Confidence: Simple Steps to Financial Security

Navigating finances can be challenging, but with wealth confidence, you can take control of your financial future. Many individuals find themselves overwhelmed by financial uncertainty, facing dwindling savings and rising debts.

This can lead to sleepless nights and constant worry. By educating yourself and taking proactive steps, you can significantly improve your wealth confidence and wealth management skills. Boost your financial confidence and wealth management skills today.

Establish Financial Goals

Defining clear financial goals is crucial to enhancing your financial security and overall wealth confidence. Begin with short-term, mid-term, and long-term objectives, and ensure they are specific, measurable, and attainable to maintain focus and motivation.

Remember to regularly review and adjust your goals to reflect changes in your circumstances and aspirations. Establishing financial priorities is essential for effective financial planning and achieving your desired financial outcomes.

Define Short-Term Objectives

Crafting clear short-term objectives gives you a roadmap for achieving your financial goals. These can include goals like reducing debt, increasing savings, or improving investment returns.

Short-term objectives often act as “stepping stones.” Setting them up as part of a holistic plan helps build confidence as these goals are more achievable and results can be seen quickly. Setting realistic goals can boost financial confidence, security, and lower stress.

Consistent progress towards these smaller goals not only enhances financial stability but also builds a solid foundation for long-term success. By regularly reassessing and adjusting these objectives, investors can remain agile and responsive to market changes.

Plan Long-Term Milestones

Strategic planning for long-term financial milestones is essential for sustained financial growth and security.

- Set Specific Goals: Outline clear, measurable financial targets such as retirement funds, property purchases, or educational expenses.

- Establish a Timeline: Create a realistic timeline for each milestone, factoring in investment growth, inflation, and personal circumstances.

- Diversify Investments: Allocate assets across various investment channels to mitigate risks and maximize returns.

- Regularly Review and Adjust: Periodically assess your progress towards each goal and make necessary adjustments to stay on track.

- Consult Financial Experts: Seek advice from financial advisors to refine strategies and ensure alignment with changing financial landscapes.

A well-defined roadmap with actionable steps promotes financial stability and confidence. Being proactive and diligent can transform long-term aspirations into attainable realities.

Control Your Spending

Develop a detailed budget that outlines all your income and necessary expenditures, prioritizing essential items. Implementing simple financial management tools (apps/spreadsheets) can provide clear visibility into your spending habits, enabling you to identify areas for cost optimization. Utilize “must-have” and “nice-to-have” lists to refocus on your ‘core expenditures’.

Create a Budget for Wealth Confidence

Establishing a budget is essential. Begin by meticulously tracking all sources of income and categorizing expenditures. This allows for a granular understanding of your financial flow, helping to pinpoint potential areas of overspending. Consistent categorization, such as fixed costs versus discretionary spending, reveals patterns that might otherwise go unnoticed.

Simplify this process. Utilize budgeting software or apps designed to streamline categorization. Most tools offer automated tracking and real-time analysis, enabling prompt adjustments and informed decision-making that are essential to sound financial management.

Continual monitoring and refinement foster a disciplined approach to managing your financial resources, ultimately enhancing your financial security and confidence. This proactive strategy is key to navigating your financial future with assurance and precision.

Track Expenses Regularly

Tracking expenses regularly is a cornerstone of robust financial management.

By monitoring your expenditures on a consistent basis, you gain a comprehensive understanding of where your money is going. This practice is indispensable for identifying spending habits, detecting unnecessary expenses, and making informed adjustments to align with your financial goals. It also adds a layer of accountability to your financial behaviors.

Leveraging technology can streamline this process. Employing financial tracking apps and software offers real-time insights, automates categorization, and provides analytical tools that help visualize your spending patterns and progress. These tools significantly ease the burden of manual tracking and promote a disciplined financial routine.

Adopting such practices enables you to make strategic, data-driven decisions, enhancing your wealth-building efforts over time. Consistent expense tracking instills a sense of control and confidence, fostering a more secure financial future.

Build Savings Safeguards

Establishing savings safeguards encompasses pre-emptive measures that protect your assets while promoting financial resilience.

For instance, consider setting up automatic transfers to dedicated savings accounts. This not only ensures consistent savings but also creates a buffer for unexpected expenses and future investments. Such “set-and-forget” strategies significantly contribute to a robust financial safety net.

Emergency Fund Tips

Creating an emergency fund is essential for financial security. It serves as a financial buffer during unexpected events, decreasing reliance on high-interest debt or loans.

To start, aim to accumulate three to six months’ worth of living expenses in a separate, easily accessible account. This provides a solid cushion in case of sudden job loss, medical emergencies, or unexpected repairs. Consistency in contributing to this fund, even with small amounts, will help grow your financial safety net over time.

Additionally, automating your contributions can make the savings process more manageable. By setting up automatic transfers from your primary account to your emergency fund, you ensure steady growth without the temptation to spend funds elsewhere.

Finally, periodically reassess your fund’s adequacy as your circumstances evolve. Life changes such as increased expenses, new dependents, or higher income levels may necessitate altering your savings targets. Regular evaluation ensures that your emergency fund remains sufficient to cover any unforeseen financial challenges.

Retirement Savings Strategies

Strategic retirement planning is critical for long-term financial stability, ensuring that you can maintain your lifestyle post-retirement.

- Maximize Employer Match on 401(k) contributions to take full advantage of available compensation.

- Diversify Investments by spreading assets across stocks, bonds, and mutual funds to mitigate risks.

- IRA Contributions provide additional tax-advantaged saving opportunities alongside employer-sponsored plans.

- Regularly Review Goals to adjust saving strategies based on market performance and changing financial needs.

Consistent annual contributions are crucial to take advantage of compound interest, significantly boosting retirement wealth. Consulting with a financial advisor can provide personalized strategies aligned with your financial objectives.

Increase Financial Knowledge

Expanding your financial literacy empowers you to make better-informed decisions, potentially enhancing your portfolio’s performance and mitigating risks.

For instance, having a solid grasp of financial instruments (stocks, bonds, mutual funds) is essential in constructing a balanced portfolio that aligns with your risk tolerance and financial goals.

Understanding terms like “diversification” and “liquidity” can be instrumental in evaluating the ‘health’ of your investments.

Read Personal Finance Books

Expanding your knowledge is crucial.

Reading personal finance books can offer deep insights into effective money management. These books provide practical advice and proven strategies to navigate complex financial landscapes, arming you with the expertise needed to make sound financial decisions. Furthermore, they serve as an ongoing resource for understanding economic trends and investment principles.

Consider classics like “Rich Dad Poor Dad.”

These texts demystify financial concepts, making them accessible. They often break down complex ideas into actionable steps, empowering you to implement these strategies in your daily life.

By immersing yourself in well-regarded literature, you build a strong foundation of financial knowledge. This helps you to understand your investments better, identify opportunities, and avoid common pitfalls. Over time, continuous learning fosters confidence and competence in managing your wealth.

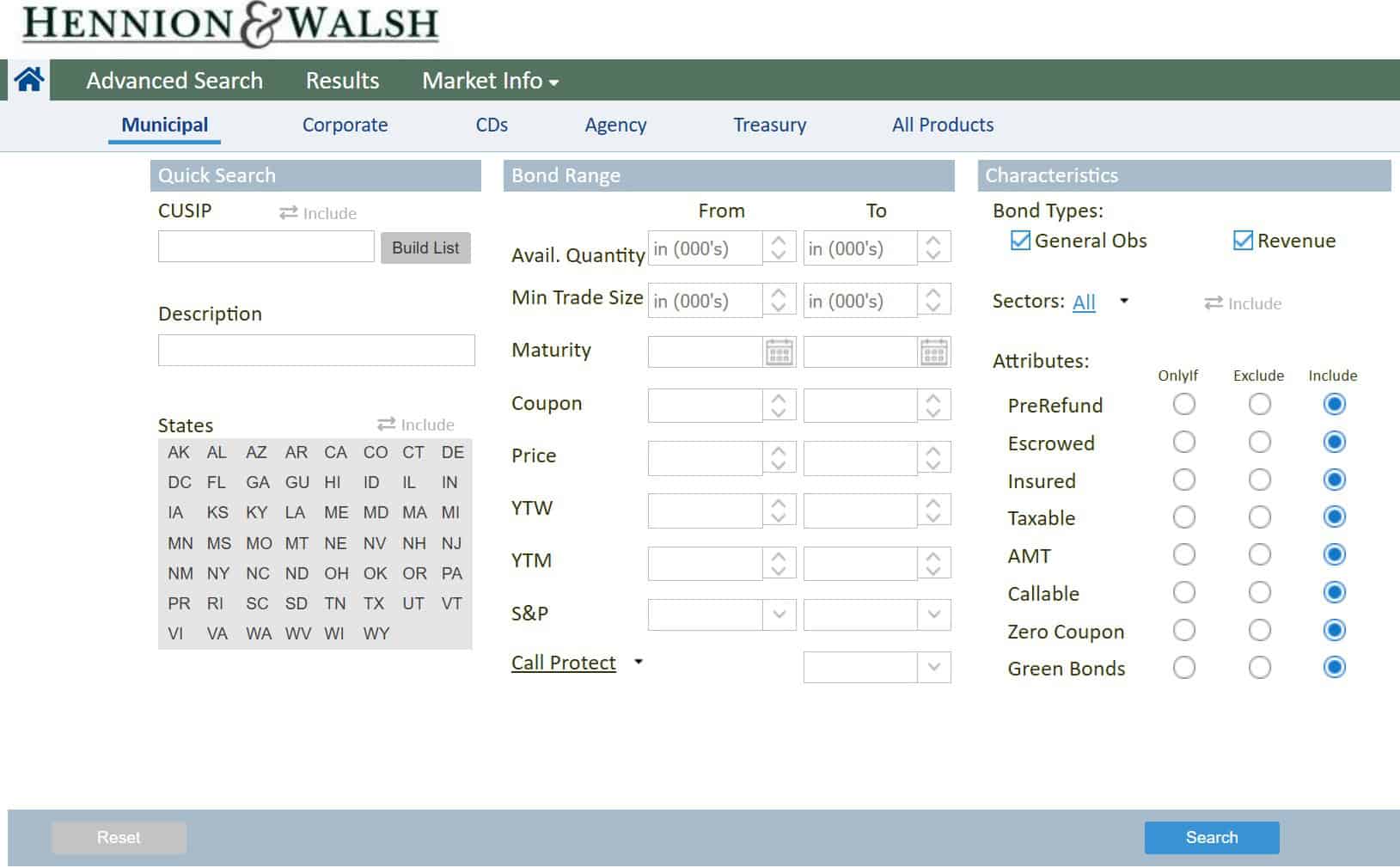

Consult with an Investment Associate

Consulting with an investment associate can significantly enhance your financial acumen, instill confidence, and provide a deeper understanding of complex economic concepts. Investment associates offer personalized, hands-on experiences that allow you to apply learned concepts immediately.

These professionals have extensive experience in finance, providing invaluable insights and tailored advice specific to your financial situation. During consultations, they cover a wide array of topics, including investments, retirement planning, tax strategies, and estate planning. They also offer opportunities to discuss your financial goals and develop a customized plan to achieve them, fostering a collaborative environment where you can share knowledge and strategies.

Ultimately, consulting with an investment associate equips you with the tools and knowledge necessary to make informed financial decisions confidently.