Last Week’s Markets in Review: Fed Stands Despite Market’s March Madness

Fed Stands Despite Market’s March Madness

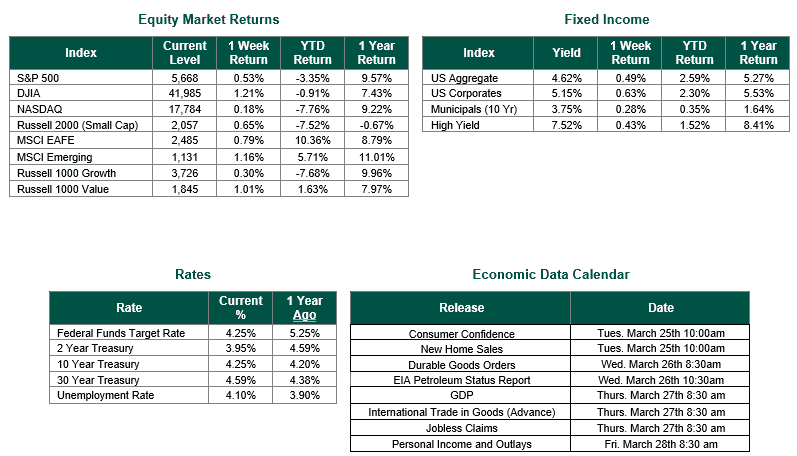

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,668, representing a decline of -0.53%, while the Russell Midcap Index moved -1.50% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.65% over the week. Developed international equity markets and emerging markets also declined, returning 0.79% and 1.16%, respectively.

Last week, the Federal Reserve, as anticipated, maintained the Federal Funds Target Rate at 4.25%-4.50%, the lowest range since December 2022. The decision aligns with market expectations and reflects a cautious stance amid economic uncertainties, including potential tariffs and policy shifts. The Fed’s updated Dot Plot forecasts 50 basis points (Bp) in rate cuts for 2025, followed by 50 Bp in 2026 and 25 Bp in 2027, targeting a long-run neutral rate of 3.0%.

A notable surprise came with the Fed’s balance sheet adjustment, reducing the monthly cap on U.S. Treasuries rolling off from $25 billion to $5 billion while keeping the $35 billion cap on mortgage-backed securities. This shift, akin to mild quantitative easing, is poised to influence longer-term yields, distinct from the short-end impact of Federal Funds Rate changes.

The Federal Reserve’s updated Summary of Economic Projections also offered some fresh insights:

- Unemployment is now expected to hit 4.4% by year-end 2025 (up from 4.3%) before dipping to 4.3% in 2026.

- Core PCE inflation is projected at 2.8% for 2025 (up from 2.5%), easing to 2.2% in 2026 and 2% in 2027.

- GDP growth is revised down to 1.7% for 2025 (from 2.1%) and 1.8% for 2026 (from 2.0%). These forecasts suggest a slowing yet stable economy.

Fed Chair Jerome Powell, in his post-announcement press conference, emphasized adaptability, hinting at a possible Q2 2025 rate cut if labor or growth weakens significantly. With no April FOMC meeting scheduled, markets could see more volatility ahead as investors speculate on the Fed’s next move—a challenging guessing game given the eight annual FOMC meetings and quarterly updates.

Last week’s stock market reflected all of the previously mentioned uncertainty. Major indices, including the S&P 500, saw choppy trading as investors digested mixed economic signals and awaited more Federal Reserve clarity. The pause and dovish undertones bolstered selective optimism, particularly in bonds and rate-sensitive sectors, though short-term fluctuations persist.

The Fed’s “wait and see” approach mirrors investor sentiment, with Powell asserting confidence in navigating this period. Over the next two years, lower rates, yields, and inflation, alongside relatively steady, though not necessarily robust, economic growth, could unlock opportunities in equities and fixed income. Yet, as Powell’s remarks underscore, only the FOMC’s votes truly shape policy—leaving market watchers to brace for a bumpy, speculative ride in 2025.

Best wishes for the week ahead!

Let Hennion & Walsh Offer a Second Opinion

Curious to learn more? Our unmatched client experience will give you peace of mind. Just as you may seek a second opinion about your health, we believe successful investors can gain value and peace of mind by getting a second opinion on their financial health. So, whether you’re worried about today’s uncertain economic environment or looking for increased peace of mind, we can help. Get a complimentary second opinion on all your investment accounts not held at Hennion & Walsh today!

Hennion & Walsh Experience

At Hennion & Walsh, every client, every individual investor, is assigned a dedicated team of investment professionals, planners, and portfolio managers, who collectively analyze your situation through the lens of their respective disciplines.

Each member brings valuable insights to apply to your situation. Whether you’re looking to meet your income needs today or stock market growth for your future, we have an expert sitting with you, helping you, and guiding you through all the scenarios to help you live the life you want.

Hennion & Walsh distinguishes itself in the investment industry with its exceptional in-house team of specialists committed to your success. Unlike other firms that rely on impersonal call centers, Hennion & Walsh provides direct access to experienced bond experts, CERTIFIED FINANCIAL PLANNER (CFP®) professionals, Chartered Financial Analyst (CFA)® charterholders, annuity professionals, and a proficient internal fixed-income trading team. Our customer service team is exceptional, ensuring that every client receives the dedicated attention and support they deserve.

Equity and Fixed Income Index returns sourced from Bloomberg on 3/21/25. Economic Calendar Data from Econoday as of 3/24/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.