Historically Low Risk

Historically low risk and reliability in preserving principal make municipal bonds a significant consideration. Highly-rated investment-grade municipal bonds, as confirmed by agencies like Moody’s and Standard & Poor’s, have long maintained a track record of low default rates. This strong performance, coupled with municipalities’ tendency to prioritize debt obligations, and the reliability of bond issuers, adds a significant layer of confidence for investors.

Understanding Municipal Bonds

Municipal bonds, often referred to as “munis,” are debt securities. They are issued by state and local governments, providing funds for public projects. These bonds can finance infrastructure improvements such as schools, highways, and hospitals. Like all bonds, municipalities promise to pay back the principal along with interest to the bondholder.

When properly managed, municipal bonds can offer a safeguard for one’s investment principal, permitting investors to align with community-enhancing projects while preserving their capital. Therefore, for those seeking to balance growth with stability, municipal bonds represent a distinguished investment avenue that upholds both ambitions.

Credit Backing of Municipal Bonds

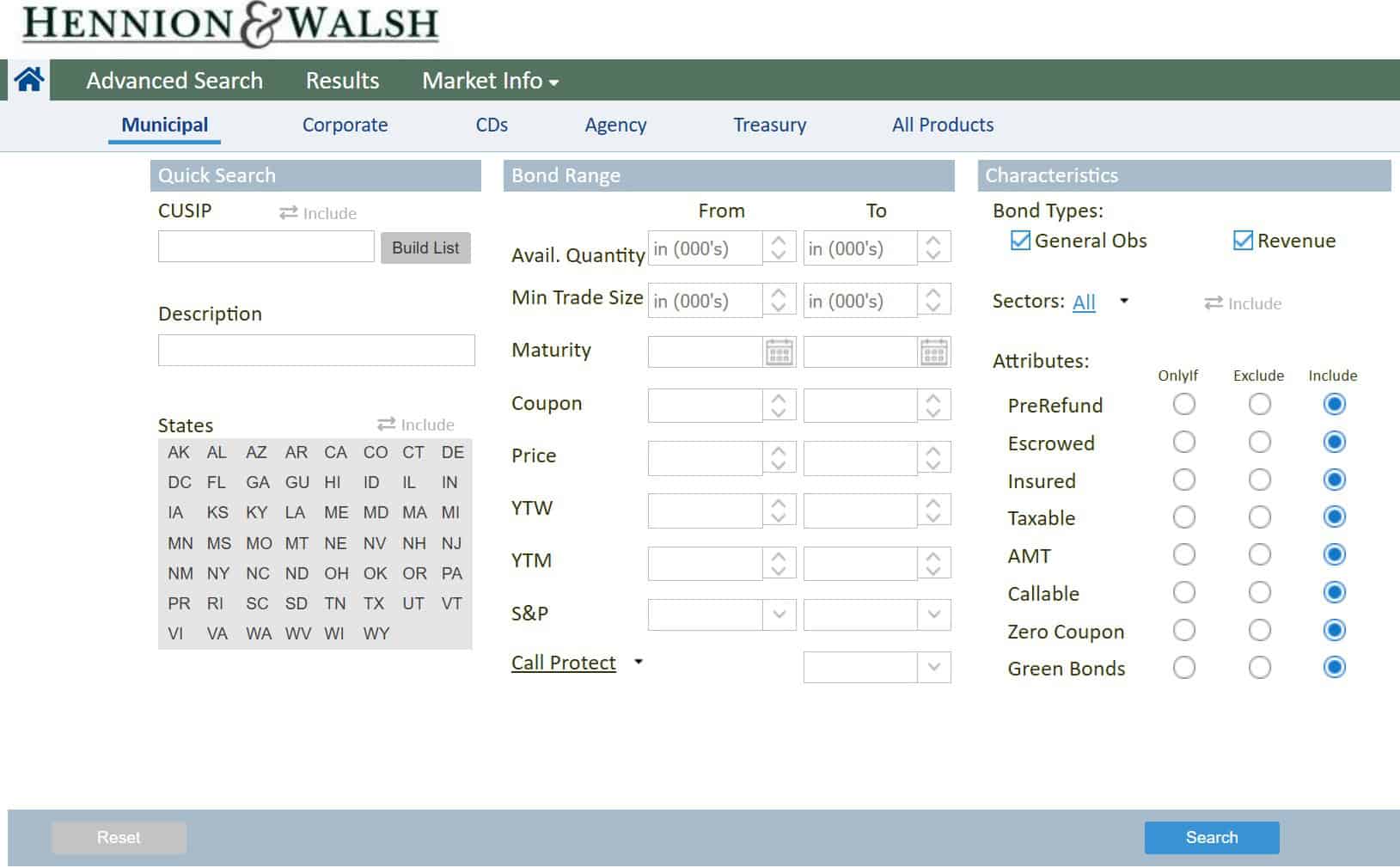

Municipalities generally rely on two different forms of revenue to generate the funds needed to pay the interest and principal due investors for municipal bonds: General Obligation (GO) bonds, backed by the full faith and credit of the municipality, including Ad Valorum Taxing power and Revenue bonds backed by the revenue generated by specific projects.

General Obligation bonds are supported by the full faith and credit of the issuing entity, which typically means they are backed by the state’s or local government’s taxing power. These bonds are often used for projects that benefit the community as a whole, such as building public schools or improving transportation infrastructure. When evaluating the security of principal and interest payments of GO bonds the tax base of the entire community should be taken into account.

On the other hand, Revenue bonds rely on income generated from specific projects like toll roads, utilities, or stadiums. The revenue from these projects is used to pay bondholders. The security of principal and interest payments depends on the project’s financial success.

In conclusion, both General Obligation and Revenue bonds have their distinctive income streams that provide credit backing. By understanding these differences, investors can make informed decisions aligned with their financial objectives.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionRisks Associated with Municipal Bonds

While municipal bonds are generally considered historically low risk, they are not without potential pitfalls. In 2016, several municipalities, including Puerto Rico’s government, defaulted, causing significant concern among bondholders. Thus, it is crucial for investors to assess a municipality’s financial health before committing any capital to their bonds.

Economic downturns and budgetary mismanagement can impact a municipality’s ability to meet its financial obligations, posing a risk to the safety of principal investments. Investors can mitigate these risks by conducting thorough research and diversifying their bond portfolio.

Evaluating the Creditworthiness of Issuers

Evaluating the creditworthiness of issuers, a critical step in assessing municipal bonds’ safety of principal, begins with rating agencies. Agencies like Moody’s and Standard & Poor’s provide indispensable insights, issuing ratings that reflect an issuer’s ability to meet its obligations.

By exploring these ratings, investors can understand a municipality’s fiscal stability, revenue streams, and overall governance. This due diligence is not merely a precaution; it is a strategic move that enhances the security of the investment principal, aligning investor confidence with informed decision-making.

Bond Ratings Explained

Bond ratings are issued by agencies—such as Moody’s—providing valuable insights into the creditworthiness of issuers. Higher-rated bonds tend to offer lower yields, reflecting their reduced risk and enhanced safety.

These ratings evaluate factors including fiscal stability and governance, helping investors gauge the likelihood of timely interest payments and principal protection. Understanding bond ratings allows investors to make informed decisions, ensuring that their investment strategy aligns with their risk tolerance and financial goals.

Importance of Financial Health

Ensuring financial health is vital. Financial stability is the bedrock of municipal bond safety. High ratings indicate a rating agency’s evaluation of the issuer’s ability to meet short-term obligations and their capacity to withstand economic downturns. Conversely, lower ratings signify increased risk, emphasizing the necessity of thorough evaluation before investment.

Stay committed to proper research. A municipality’s financial health significantly impacts the safety of principal investments. In-depth analysis and a focus on top-rated municipal bonds can safeguard an investor’s capital.

By prioritizing financial health, investors can unlock sustained success amid evolving market conditions, ensuring a resilient portfolio that navigates uncertainty with confidence. Seek bonds from issuers demonstrating strong fiscal prudence, reliable revenue sources, and robust financial strategies—a formula for protecting the principal and achieving long-term prosperity.

Market Performance of Municipal Bonds

Market risk for tax-free municipal bonds is primarily based on the overall interest rate environment in the economy. When economic interest rates rise, the value of individual municipal bonds fall. When interest rates fall, the value of individual bonds increases.

Another factor in the market risk for municipal bonds is tax rate fluctuations. As tax rates increase, municipal bond values go up. As tax rates drop municipal bonds typically go down in value.

Individual municipal bond issues may also have market adjustments due to credit concerns on individual issuers. But for the most part when compared to other fixed-income investments, such as corporate bonds, municipal bonds tend to present lower default risks, which can make them attractive to risk-averse investors. Historically, issuers of municipal bonds have shown a consistent resistance to significant credit based dips.

This makes them a safer bet.

For more information on tax-free municipal bonds, please contact a Hennion & Walsh Municipal Bond specialist.

Impact of Economic Conditions on Municipal Bonds

Economic conditions greatly affect municipal bonds. During robust economic periods, cities and states have higher revenues. This influx of funds can lead to more reliable interest payments and a greater assurance of protecting investment principal. Conversely, downturns in the economy can create fiscal strain on municipal budgets, posing potential risks to bondholder returns.

Local economies also play significant roles. Consider the diverse impact of economic cycles—while one region may thrive and meet obligations due to strong local governance and economic diversification, another might face challenges. Hence, the economic well-being of a locality can significantly influence the safety of principal in municipal bonds.

Investors should continuously monitor economic conditions to anticipate potential shifts in risk levels. By staying informed and selecting bonds from economically stable regions, one ensures their portfolios maintain resilience amidst economic fluctuations.

Expert Opinions on the Safety of Principal

Financial analysts widely recognize municipal bonds as some of the most historically low risk investments for principal protection.

Leading experts, in various comprehensive studies on municipal bonds, highlight their consistent performance, even amid economic challenges. These reports indicate that municipalities typically prioritize debt obligations, resulting in rare defaults compared to other bond types.

Furthermore, ratings agencies such as Moody’s and Standard & Poor’s provide regular assessments. These ratings give investors insight into the financial health of issuing municipalities, allowing them to make informed decisions about the risk associated with potential investments.

As financial planners often suggest, high-rated municipal bonds offer not only the security of principal but also attractive tax advantages. This combination makes them particularly appealing for risk-averse investors looking to safeguard their investments while ensuring a steady income stream. Their confidence in municipal bonds underscores the vital role these instruments play in a balanced portfolio.

Conclusion

Municipal bonds present a compelling case for their relative safety of principal. With their consistent historically low risk, reliable ratings, and additional tax benefits, these instruments emerge as a resilient option in safeguarding one’s investment and earning tax-free income. Investors can indeed feel optimistic about incorporating municipal bonds into their diversified portfolios.

All investments involve risk, including loss of principal. Past performance does not guarantee future returns. The interest on municipal bonds, unless identified as “taxable” or “AMT” (alternative minimum tax), is exempt from federal income tax, but may be subject to state income tax for residents of certain states. For bonds identified as “taxable,” the income may be subject to federal and state income tax. For bonds designated “AMT”, taxes may exist for certain investors. Bonds purchased at a market discount or bonds identified as “OID” (original issue discount) the difference between the purchase price and par value may be treated as taxable interest rather than capital gain.

*Source: Moody’s Investor Service, April 21, 2022 “US Municipal Bond Defaults and Recoveries, 1970–2021.”

Looking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.