What Are Tax-Free Municipal Bonds?

How Tax-Free Municipal Bonds Work

Investors can pursue financial growth while reducing tax burdens with tax-free municipal bonds. These securities often provide income exempt from federal, state, and local taxes, depending on your location. They strengthen portfolios, offer stable returns, and support vital public projects like schools and infrastructure.

What Are Tax-Free Municipal Bonds?

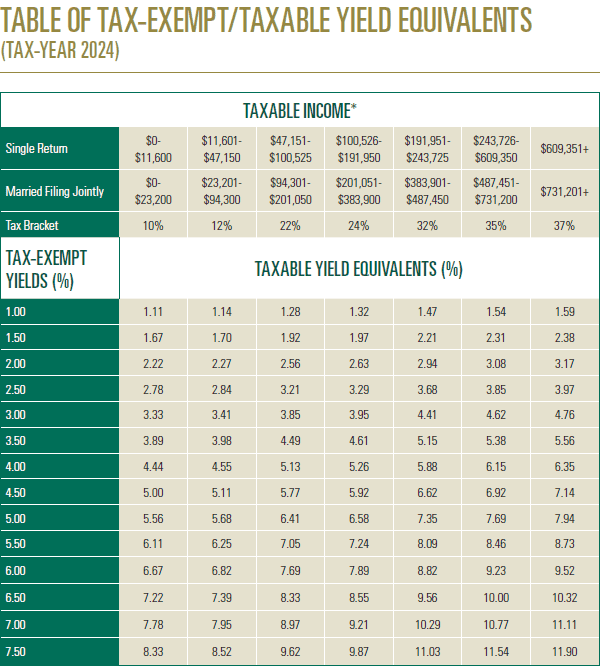

Tax-free municipal bonds, or munis, are issued by local governments and entities like states and school districts to fund public projects. They offer investors a fixed income with interest payments typically exempt from federal income tax, making them particularly appealing to those in higher tax brackets seeking to maximize after-tax returns. Additionally, these bonds may be exempt from state and local taxes for investors residing in the issuing state. However, not all municipal bonds qualify for this exemption, so it’s essential to confirm the tax status before investing.

During economic uncertainty and fluctuating interest rates, the demand for munis often increases due to their stability and predictable income, making them an excellent choice for conservative investors. By investing in these bonds, individuals can align their financial goals with community support, embodying a forward-thinking approach to financial planning.

Benefits of Tax-Free Municipal Bonds

Investors value them for their tax-exempt interest, which enhances net income by allowing them to keep more earnings. Beyond federal tax benefits, state and local tax exemptions increase their profitability, especially for high-income individuals.

These bonds support both personal financial growth and community projects, offering a unique blend of financial gain and civic contribution. They promise fiscal responsibility and personal gain, providing stable income while fostering community development.

Types of Tax-Free Municipal Bonds

Tax-free municipal bonds come in various forms, catering to diverse public needs and fiscal goals.

- General Obligation Bonds: Backed by the issuer’s full faith and credit, meaning they are secured by the issuer’s taxing authority and overall financial resources.

- Revenue Bonds: Repayment is tied to specific revenue sources like tolls or lease fees.

Each bond type funds vital infrastructure projects and offers beneficial returns to investors. Some issuances include protective covenants to ensure timely interest payments and principal repayment. These bonds offer opportunities to align personal financial goals with community initiatives, driving progress and prosperity.

How to Invest

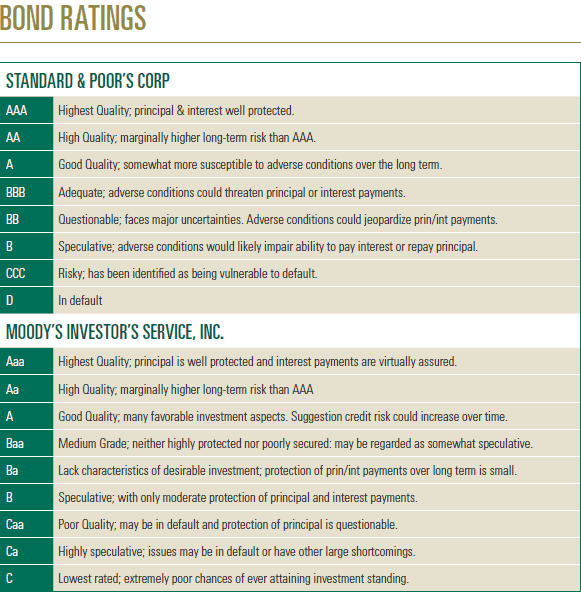

Investing in these bonds provides consistent income while supporting public projects. Begin by defining your investment goals, assessing your risk tolerance, and deciding between long-term growth or immediate income. Explore municipal bond offerings through brokerage platforms or investment professionals specializing in fixed-income securities. Evaluate potential bonds by considering credit ratings, interest rates, coupon rates, and maturity, as well as the issuer’s fiscal health and the project’s social impact. With informed decisions, this investment can effectively balance personal wealth growth with community advancement.

Risks of Tax-Free Municipal Bonds

These securities come with notable risks:

- Interest Rate Risk: Bond values may decline as interest rates rise, reducing potential resale prices.

- Credit Risk: The financial health of municipalities affects their ability to meet obligations, posing a potential risk to investors.

- Liquidity Risk: Limited market demand could restrict buying or selling opportunities.

- Tax Policy Risk: Changes in tax laws could alter the bonds’ tax-exempt status, impacting their attractiveness. Staying informed about tax reforms is crucial for effective planning.

Despite these risks, municipal bonds remain a valuable option for investors prioritizing stability, consistent income, and community-focused growth.

For more information, please contact a Hennion & Walsh Municipal Bond specialist.

All investments involve risk, including loss of principal. Past performance does not guarantee future returns. The interest on municipal bonds, unless identified as “taxable” or “AMT” (alternative minimum tax), is exempt from federal income tax, but may be subject to state income tax for residents of certain states. For bonds identified as “taxable,” the income may be subject to federal and state income tax. For bonds designated “AMT”, taxes may exist for certain investors. For bonds purchased at a market discount or bonds identified as “OID” (original issue discount) the difference between the purchase price and par value may be treated as taxable interest rather than capital gain.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionLooking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.