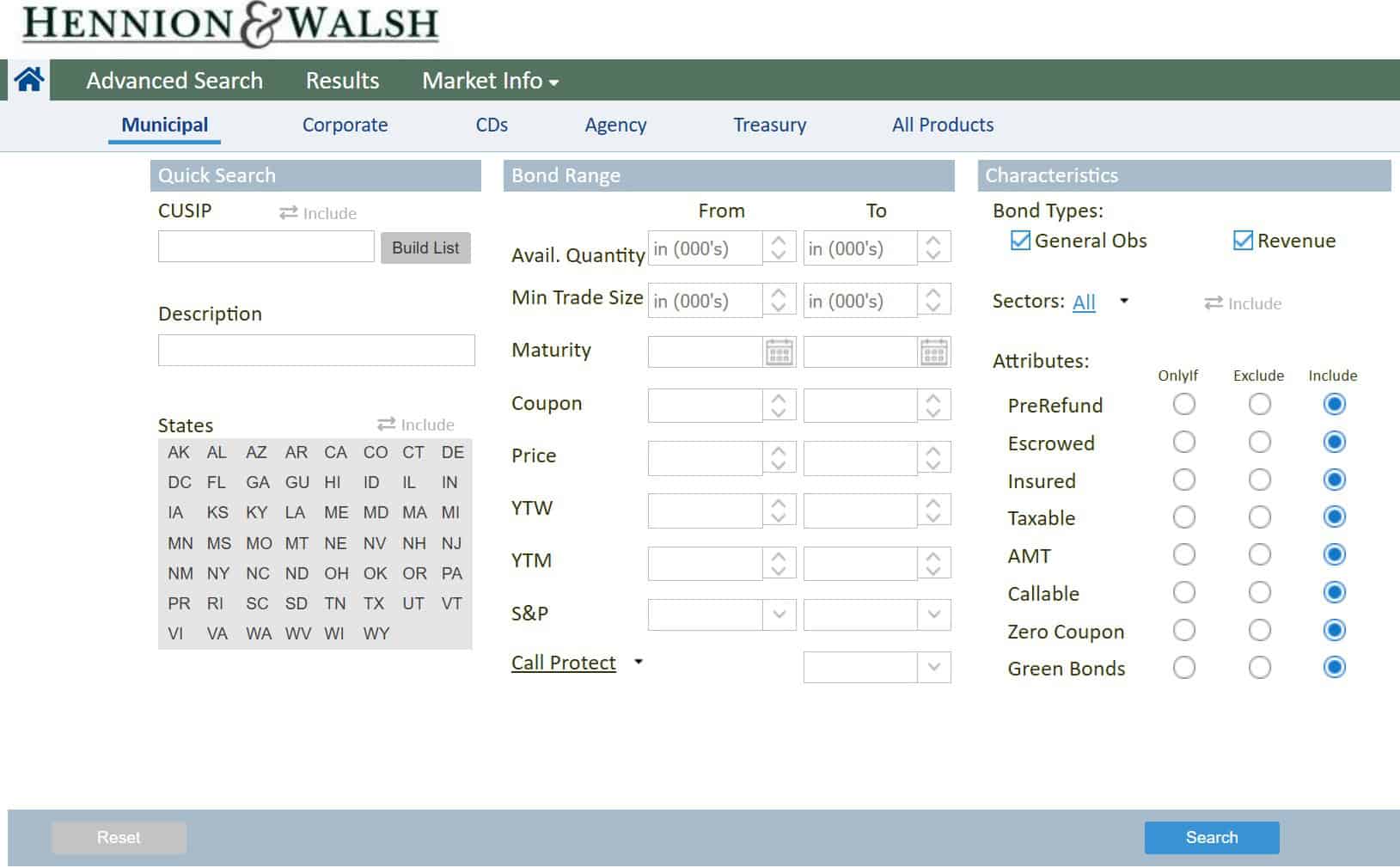

Certificates of Deposit

What are Certificates of Deposit?

Banks and credit unions offer Certificates of Deposit as financial instruments. They are similar to savings accounts but with a few key differences. When you invest in a CD, you agree to keep your money with the bank for a specific period of time, known as the term. In return, the bank pays you a fixed interest rate on your investment. At the end of the term, you receive your initial investment plus the accumulated interest.

Benefits of Certificates of Deposit

- Safety and Security: One of the main advantages of CDs is their safety and security. Unlike stocks or bonds, the Federal Deposit Insurance Corporation (FDIC) insures CDs for up to $250,000 per depositor, per insured bank. This means that even if the bank fails, your investment is protected.

- Guaranteed Returns: CDs offer a fixed interest rate for the entire term of the investment. This means that you know exactly how much you will earn on your investment, regardless of market fluctuations. This predictability can be especially appealing to investors in municipal bonds who prefer a stable and reliable source of income.

- Diversification: Investing in CDs can help diversify your investment portfolio. Municipal bonds are already considered a safe investment but adding CDs to the mix can further reduce risk. By spreading your investments across different asset classes, you can minimize the impact of any one investment on your overall portfolio.

- Flexibility: CDs come in various terms, ranging from a few months to several years. This flexibility allows investors to choose the term that best suits their financial goals. If you have a short-term goal, such as saving for a down payment on a house, you can opt for a shorter-term CD. On the other hand, if you are planning for retirement, a longer-term CD may be more appropriate.

- Higher Interest Rates: Compared to traditional savings accounts, CDs generally offer higher interest rates. This means that your money can grow at a faster pace, helping you reach your financial goals sooner. For investors in municipal bonds, this can be an attractive option to maximize their savings and increase their overall return on investment.

Certificates of Deposit can be a suitable taxable alternative for investors in municipal bonds. They offer safety, guaranteed returns, diversification, flexibility, and higher interest rates. By including CDs in your investment strategy, you can maximize your savings and secure your financial future. So, don’t overlook the potential of CDs when planning your investment portfolio. Start exploring the options available to you and take advantage of the benefits that Certificates of Deposit have to offer.

For more information on CD’s, please contact a Hennion & Walsh investment professional

All investments involve risk, including loss of principal. Past performance does not guarantee future returns.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionLooking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.