Insurance

The Benefits of Life Insurance and Long-Term Care Policies for Retirement Planning

Retirement planning is a crucial aspect of financial management. Especially for older investors who are looking to optimize their net worth during their golden years. While there are various investment vehicles available, life insurance and long-term care policies stand out as excellent options for retirement planning.

Protecting Your Loved Ones and Building Wealth

Life insurance is often associated with providing financial protection for loved ones in the event of the policyholder’s death. However, it can also serve as a valuable investment tool for retirement planning. Here are some key benefits of incorporating it into your retirement strategy:

Tax Advantages

One of the significant advantages of life insurance is its tax benefits. The death benefit paid to beneficiaries is generally tax-free. Providing financial security to your loved ones without the burden of taxes. Additionally, certain types of policies, such as cash value, offer tax-deferred growth on the cash value component. This means that the policyholder can accumulate wealth over time without immediate tax obligations.

Supplemental Retirement Income

Policies with cash value accumulation can serve as a source of supplemental retirement income. As the cash value grows, policyholders can access it through policy loans or withdrawals. This provides a steady stream of income during retirement. This additional income can help cover living expenses, healthcare costs, or even fund travel and leisure activities.

Estate Planning and Wealth Transfer

Life insurance can play a crucial role in estate planning and wealth transfer. By designating beneficiaries, policyholders can ensure that their loved ones receive a tax-free death benefit, which can be used to pay off debts, cover funeral expenses, or provide an inheritance. This allows for a smooth transfer of wealth to the next generation, minimizing potential estate taxes and probate costs.

Long-Term Care Policies: Protecting Your Assets and Independence

As individuals age, the need for long-term care becomes a reality for many. Long-term care policies offer financial protection and peace of mind by covering the costs associated with extended care services. Here’s why incorporating long-term care policies into your retirement plan is essential:

Asset Protection

Long-term care can be expensive, and without proper planning, it can quickly deplete your retirement savings. Long-term care policies help protect your assets by covering the costs of nursing homes, assisted living facilities, in-home care, and other related services. By having a policy in place, you can ensure that your hard-earned savings are preserved for other retirement expenses or passed on to your beneficiaries.

Independence and Choice

Long-term care policies provide individuals with the freedom to choose the type of care they desire. Whether it’s receiving care in the comfort of their own home or in a specialized facility, policyholders have the flexibility to make decisions based on their preferences and needs. This independence allows retirees to maintain their quality of life and age with dignity.

Peace of Mind

Planning for long-term care can alleviate the stress and uncertainty associated with aging. By having a long-term care policy, you can rest assured knowing that you have a financial safety net in place. This peace of mind allows you to focus on enjoying your retirement years without worrying about the potential financial burden of long-term care.

Conclusion

In conclusion, life insurance and long-term care policies offer numerous benefits for retirement planning. From tax advantages and supplemental income to asset protection and peace of mind, these policies provide a comprehensive approach to securing your financial future. As you navigate your retirement journey, consider incorporating life insurance and long-term care policies into your overall financial strategy to optimize your net worth and ensure a prosperous retirement.

Note: While in some instances, Medicare may pay for some of your nursing home expenses, it will not cover the cost of care in an assisted living facility. If the care that is needed is to help maintain one’s standard of living then Long Term Care insurance can help offset those costs.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionAll investments involve risk, including loss of principal. Past performance does not guarantee future returns.

Looking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

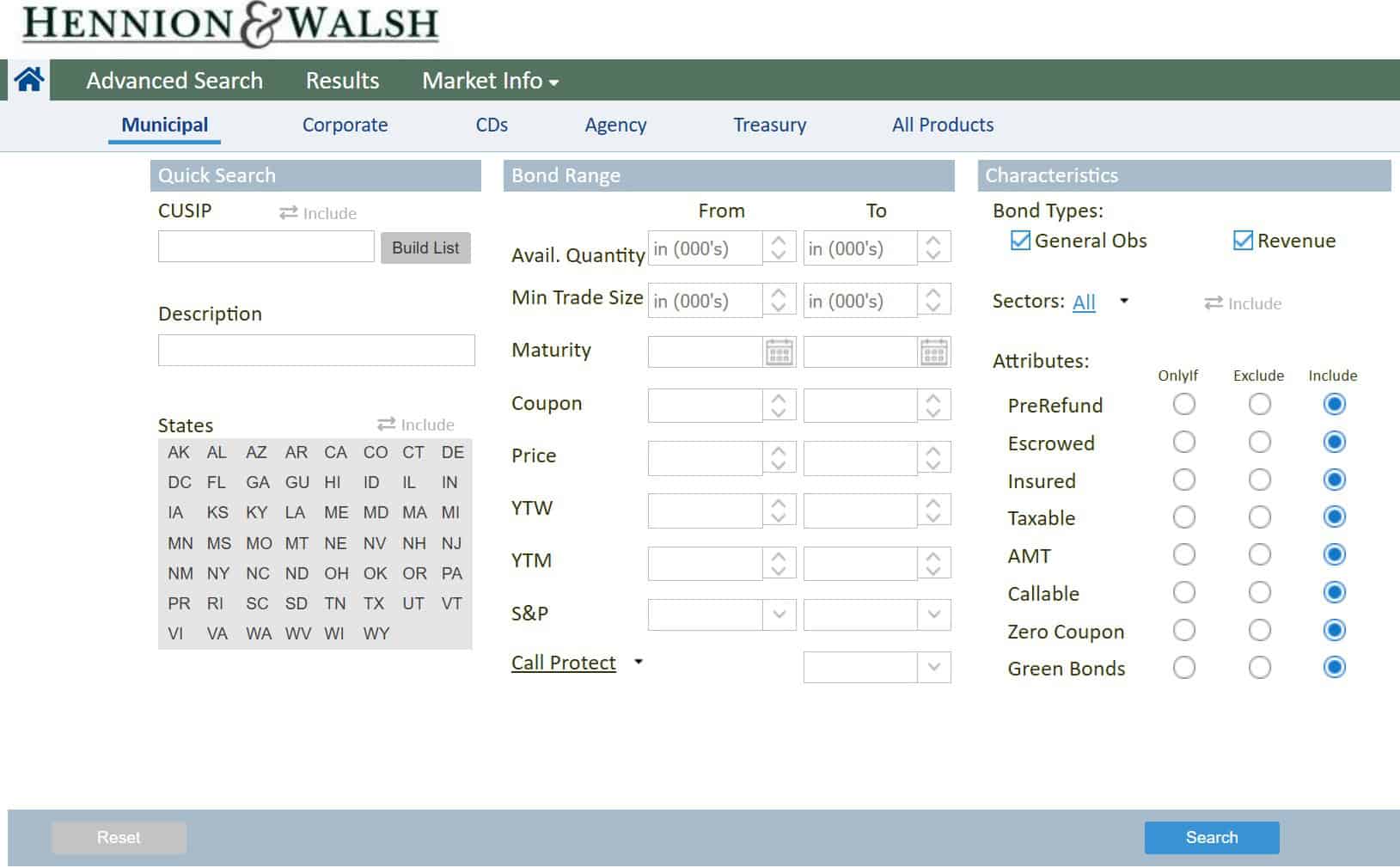

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.