Taxable Municipal Bonds

Understanding Taxable Municipal Bonds: What You Need to Know

Taxable municipal bonds are an investment option that may be worth considering for investors looking to diversify their portfolios. While municipal bonds are typically tax-exempt, these bonds are subject to federal income tax. In this article, we will explore what they are, how they work, and the benefits and risks associated with investing in them.

What are They?

Municipal bonds are debt securities issued by state and local governments to finance public projects such as infrastructure development, schools, and hospitals. These bonds are generally exempt from federal income tax, making them an attractive investment for individuals in higher tax brackets. However, not all municipal bonds enjoy tax-exempt status.

Taxable municipal bonds, as the name suggests, are bonds that are not exempt from federal income tax. They are issued by municipalities for projects that do not qualify for tax-exempt status, such as sports stadiums, convention centers, or private development projects. The interest earned from them is subject to federal income tax but may still be exempt from state and local taxes, depending on the bond issuer and the investor’s state of residence.

How Do They Work?

They work similarly to other types of bonds. When you invest in this bond, you are essentially lending money to the issuing municipality. In return, the municipality promises to pay you periodic interest payments, usually semi-annually, and return the principal amount at maturity.

The interest rates are typically higher than those on tax-exempt municipal bonds to compensate for the tax liability. The interest payments are subject to federal income tax at the investor’s marginal tax rate. It’s important to note that these bonds may have a lower yield compared to other taxable investments, such as corporate bonds or Treasury securities.

Benefits of Investing in Taxable Municipal Bonds

While these municipal bonds are not tax-exempt, they still offer some advantages for investors. One of the main benefits is the potential for higher yields compared to tax-exempt municipal bonds. This can be particularly attractive for investors in lower tax brackets or those who have already maxed out their tax-exempt investment options.

Additionally, they provide diversification opportunities for investors. By including them in your portfolio, you can balance the tax-exempt income from other investments with taxable income from these bonds. This can help reduce the overall tax impact on your investment returns.

Risks of Investing

Like any investment, taxable municipal bonds come with their own set of risks. One of the primary risks is the creditworthiness of the bond issuer. It’s important to research and evaluate the financial health of the municipality before investing in its bonds. Municipalities with lower credit ratings may offer higher yields but also carry a higher risk of default.

Another risk to consider is interest rate risk. When interest rates rise, the value of existing bonds typically decreases. This can result in a decline in the market value. However, if you hold the bonds until maturity, you will still receive the full principal amount.

These bonds can be a valuable addition to an investor’s portfolio, providing diversification and potentially higher yields compared to tax-exempt municipal bonds. However, it’s crucial to carefully evaluate the creditworthiness of the bond issuer and consider the potential risks associated with interest rate fluctuations. Consulting with an investment professional can help you determine if taxable municipal bonds are suitable for your investment goals and risk tolerance.

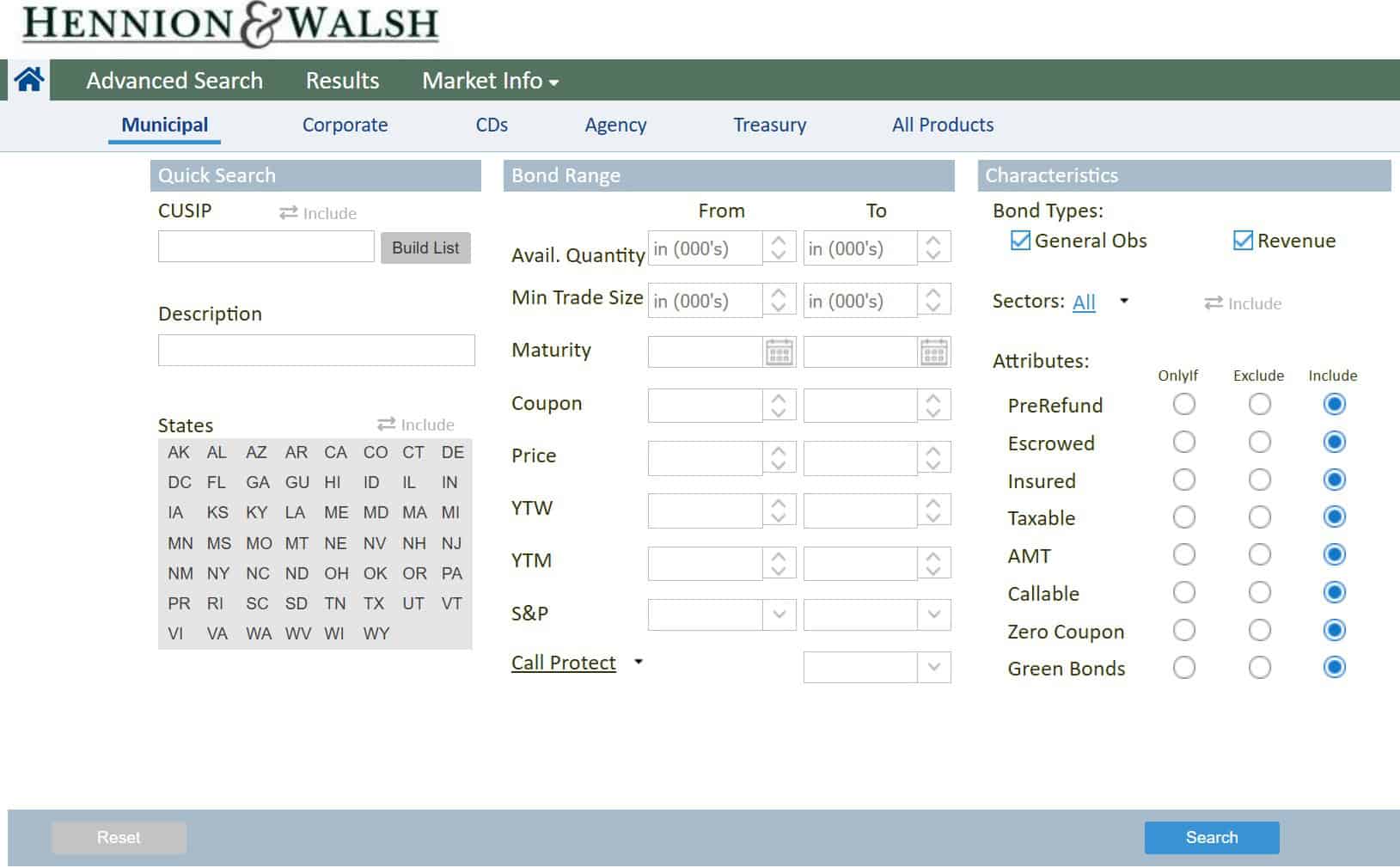

For more information, please contact a Hennion & Walsh Municipal Bond specialist.

All investments involve risk, including loss of principal. Past performance does not guarantee future returns.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionLooking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.