Zero Coupon Bonds

Zero coupon bonds are a unique investment option that can be attractive to investors in municipal bonds. In this comprehensive guide, we will explore what they are, how they work, and the potential benefits and risks associated with investing in them.

What are Zero Coupon Bonds?

Zero coupon bonds, also known as Capital Appreciation bonds, are fixed-income securities that do not pay regular interest like traditional bonds. Instead, they are sold at a discount to their face value and pay the full face value at maturity. This means that investors can purchase these bonds at a discounted price and receive a lump sum payment when the bond matures.

How do They Work?

When you invest in one of these bonds, you are essentially lending money to the issuer, whether it’s a municipality, a corporation or the Federal Government. The bond is issued with a fixed maturity date, typically ranging from a few months to several years. During the holding period, the bond does not pay any interest income for the investor.

Since these bonds sell at a discount, investors can buy them for less than their face value. When the bond matures, the investor receives the full face value. This potential for significant capital appreciation is the key distinction between zero coupon bonds and traditional coupon bonds.

Benefits of Investing

Because these bonds sell at a discount, investors can benefit from the compounding effect of the bond’s face value over time. This can be particularly advantageous for long-term investors who are willing to hold the bond until maturity.

Another advantage is their fixed maturity date. This allows investors to plan their investment horizon more effectively and align it with their financial goals.

Risks of Investing

While zero coupon bonds offer attractive benefits, it’s important to consider the risks associated with this investment option. One of the main risks is the lack of regular interest payments. This means that investors will not receive any income until the bond matures, which may not be suitable for those who rely on regular cash flow from their investments.

Another risk to consider is the potential for interest rate fluctuations. Changes in interest rates can affect their market value because they are sensitive to these changes. If interest rates rise, the value of these bonds may decline, potentially resulting in a loss for investors who sell before maturity.

Zero coupon bonds can be a valuable addition to an investor’s portfolio. Their unique characteristics offer the potential for higher returns and stability, but it’s important to carefully consider the risks involved. By understanding how these bonds work and conducting thorough research, investors can make informed decisions and optimize their investment strategy.

Remember, these bonds are just one investment option among many, and it’s crucial to diversify your portfolio to mitigate risk. Consult with a financial advisor or investment professional to determine if this bond type aligns with your investment goals and risk tolerance.

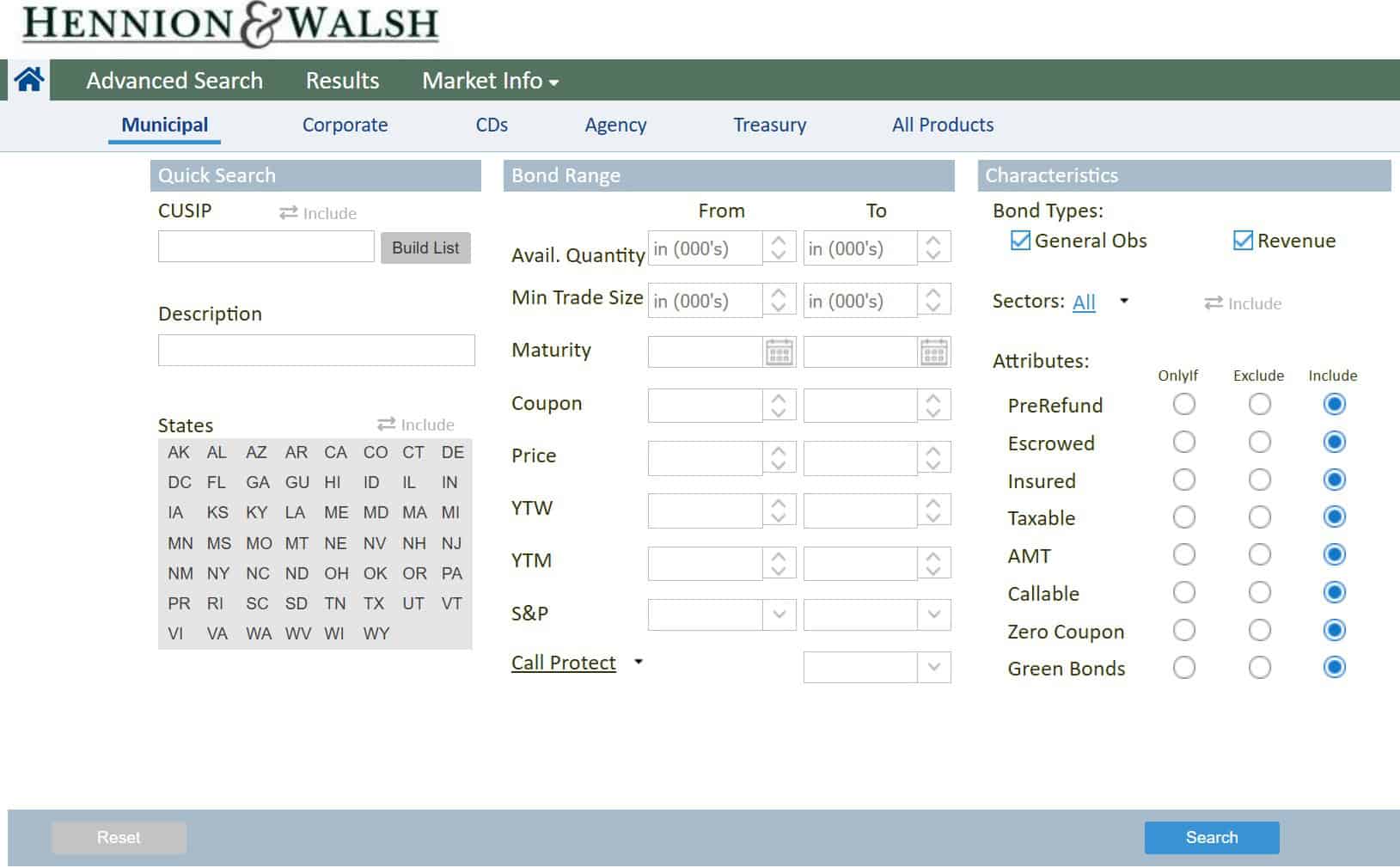

For more information on zero coupon bonds, please contact a Hennion & Walsh investment professional.

Want a second opinion?

You get a second opinion when you hire a contractor or get medical advice. Why not for your investments? Schedule a session today to receive a second opinion. It’s free and without obligation.

Second OpinionAll investments involve risk, including loss of principal. Past performance does not guarantee future returns.

Looking for related insights?

We love to help educate investors, so our experts write insights, articles and content we believe you’ll find interesting and engaging. Find a topic that interests you below.

The Hennion and Walsh Experience

We provide a truly great and different investment experience you won’t find anywhere else to help you live the life you want in retirement.